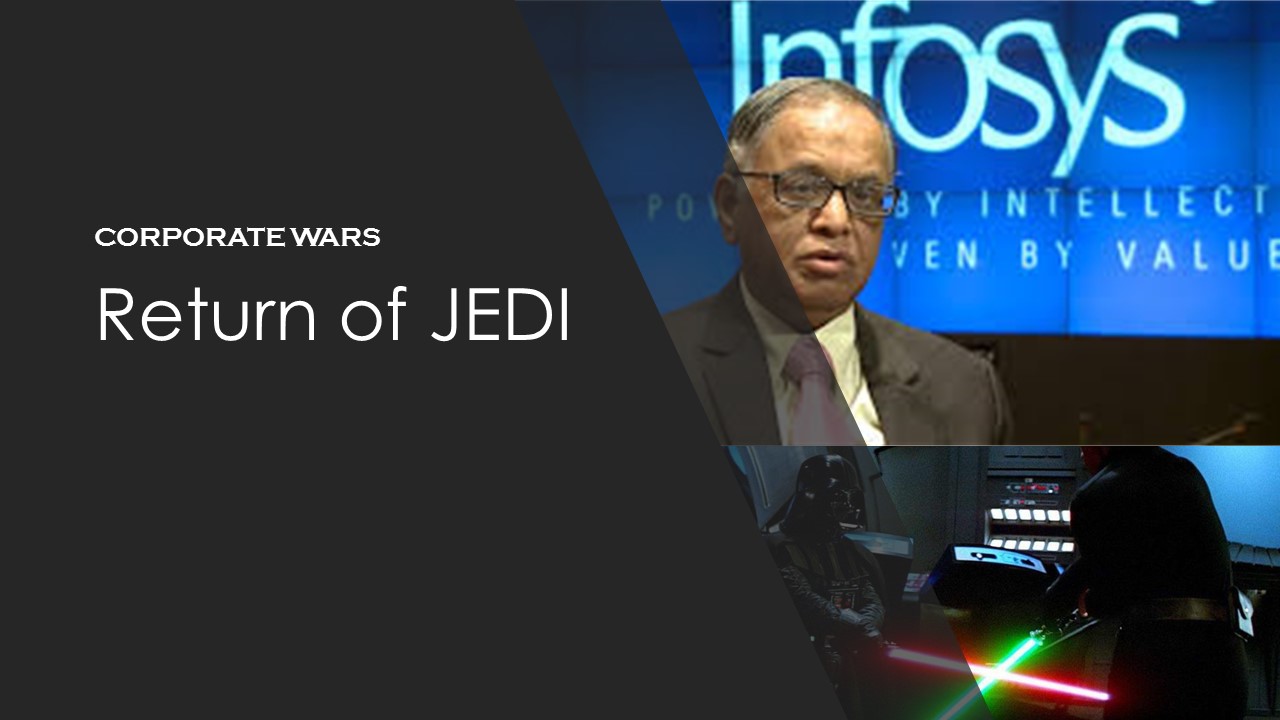

Return of the Corporate JEDI

"May the Force be with you"

For those un-initiated into the Star Wars saga – this is the phrase used by theJedi – a towering personality of hero's who served and used the mystical energies of the universal Force, to fight for peace and justice.

The Indian Boardroom and its governance battles have been in the news lately. The TATA Board room battles rocked the courts and media in 2016. While the war cry is yet to die down, at the start of 2017 we’ve witnessed the new challenge at Infosys – India’s second largest IT services company.

The ongoing salvo has been fired by the visionary and JEDI-like Founder NR Narayana Murthy (NRN), after he voiced out his dissent on the exorbitant salary increase approved for the Infosys COO. NRN said, the pay hike was unfair, compared to the wage hikes given to the rest of the employees in the company and that this high level of salary increase would erode the trust of the employees.

NRN believes in the principle of Compassionate Capitalism, according to which the salary differences between the top Executive and the average company employee should not be increasing drastically year-on-year.

According to him "I have always felt that every senior management person of an Indian corporation has to show self-restraint in his or her compensation. He or she has to fight for maintaining a reasonable ratio between the lowest salary and the highest salary in a corporation in a poor country like India. The board has to create a climate of opinion for such a fairness by their actions."

As the Founder, he has cited concern with the Board governance evidenced in the past and is now influencing to shake up the Board composition if Directors do not heed in to the concerns.

What is Corporate Governance

Corporate governance is a system of structures and processes that help to direct and control large companies. Shareholders appoint the Board of Directors who then oversee the role of executive management to ensure good governance, compliance to lawful practices and business growth objectives.

A Historical Perspective from 400 BC

In India, the origins of corporate governance can be traced back to 400 years BC, when Chanakya - the famous Teacher, Statesman and guide to the Mauryan Emperor Chandragupta wrote the Sanskrit treatise ‘ArthaShastra’. The title includes books on the nature of government, law, ethics, diplomacy, theories on war & peace and the duties and obligations of a King. He established that the King and his Ministers mist always follow a disciplinary code and act in the best interests of their subjects.

Likewise, Corporate Governance codes continue to evolve today supported jointly by the private and regulatory bodies to ensure that the interests of all Shareholders and Stakeholders in the company are met.

Pillars of good governance

Trust is the key foundation to build a good corporate edifice and there are 4 good governance pillars:

Transparency – Board of Directors will need to be transparent with Shareholders, why all key decisions were made

Accountability – Directors are held accountable to Shareholders for all actions

Fairness – all Shareholders should receive equal and unbiased consideration by the Board and Executive Management

Responsibility – Board is expected to conduct themselves with doing-the-right-thing

Infosys Board perspective

As with the recent public dissent aired by the Founder shareholders – it is evident that Trust is under duress and needs to be strengthened.

While the Board and Executive Management justify the pay hikes as standard industry benchmark practices to retain star CXO talent – a key shareholder remains unconvinced on the quantum of pay hike, given the current economic environment and strong headwinds to business.

Executive Management perspective

CXO's feel they are entitled to generous wage and bonuses that are routinely tied to company KPIs – given that the average tenure of the CXO is trending to go downwards.

While CXO's build a great business for the shareholders that will be a lasting piece of business for the Shareholders, it is the executive management that should also wet-their-beaks with short term benefits, given the shorter role responsibility timelines while fielding an unduly large amount of stress and accountability for results.

Industry analysts view

Other analysts too have thrown their weight behind the Board, opining that Board should be left free to their decisions and should not be pre-empted by non-Board members on strategy. Some feel, Shareholders can exercise their voting rights to evaluate and dismiss non-performing Board members.

Few HR analysts have expressed that executive compensation is an element of the company’s people strategy. Given the complexity of management in a transnational organization, one should not draw comparisons between CXO compensation and the average manager. Some experts believe that the ratio of compensation gap could widen in future due to intense global pressures on business and the challenge of finding good talent to run the company.

The Governance Continuum

While the debate between Capitalism and Socialism rages globally in a weakened economic environment, neither one side can claim to offer a stable alternative to the other. Both will continue to exist as a check and balance.

Which side would you weigh on?

This might depend on which side are you currently based at. Feel free to debate in the opinions.

The principle based corporate governance approach of the Jedi’s will keep them coming. Their sparring and/or engagement would continue to invite much interest from the shareholders and stakeholders in the large Enterprise.

The Jedi way of life believes in the inclusion of all constituents within the economy and that our sense of morality is inborn amongst all.

Silence your mind and feel the force within you!